2 Segment information

Changes in segment reporting

As of 1 January 2021, Swisscom amended its organisational structure in Switzerland and the segment formerly known as IT, Network & Infrastructure was renamed Infrastructure & Support Functions. The departments with overlapping functions were merged organisationally at Swisscom Switzerland. As a result, Group Headquarters is no longer reported separately in the segment reporting. In addition, Swisscom has transferred various areas among the segments of Swisscom Switzerland and the Other Operating Segments as of 1 January 2021. The prior year’s figures were restated as follows:

| In CHF million | Reported | Adjustment | Restated | |||

|---|---|---|---|---|---|---|

| Net revenue 2020 financial year | ||||||

| Residential Customers | 4,564 | (4) | 4,560 | |||

| Business Customers | 3,100 | – | 3,100 | |||

| Wholesale | 976 | – | 976 | |||

| Infrastructure & Support Functions (previously IT, Network & Infrastructure) | 85 | (2) | 83 | |||

| Elimination | (450) | (19) | (469) | |||

| Swisscom Switzerland | 8,275 | (25) | 8,250 | |||

| Fastweb | 2,470 | – | 2,470 | |||

| Other Operating Segments | 1,020 | (6) | 1,014 | |||

| Elimination | (665) | 31 | (634) | |||

| Total net revenue | 11,100 | – | 11,100 | |||

| Segment result 2020 financial year | ||||||

| Residential Customers | 2,586 | (2) | 2,584 | |||

| Business Customers | 1,235 | 3 | 1,238 | |||

| Wholesale | 523 | – | 523 | |||

| Infrastructure & Support Functions (previously IT, Network & Infrastructure) | (2,556) | (64) | (2,620) | |||

| Swisscom Switzerland | 1,788 | (63) | 1,725 | |||

| Fastweb | 166 | – | 166 | |||

| Other Operating Segments | 111 | (1) | 110 | |||

| Group Headquarters | (64) | 64 | – | |||

| Elimination | (99) | – | (99) | |||

| Total segment result | 1,902 | – | 1,902 | |||

General information

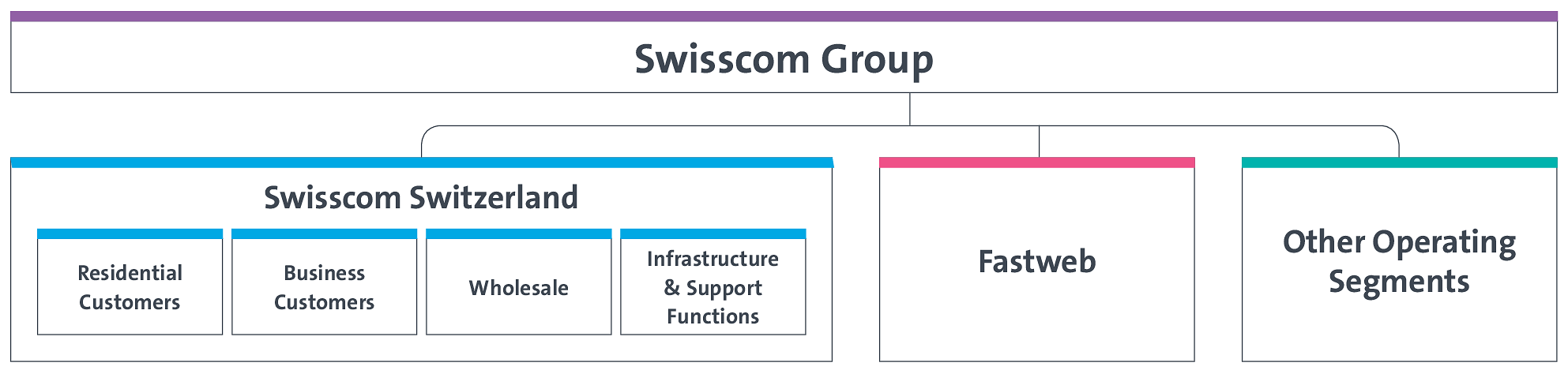

Reporting is divided into the segments Residential Customers, Business Customers, Wholesale, and Infrastructure & Support Functions, which are grouped under Swisscom Switzerland, as well as Fastweb and Other Operating Segments.

The Infrastructure & Support Functions segment does not charge network costs or management fees to other segments. Any other services between the segments are charged at market prices. The results of the Residential Customers, Business Customers and Wholesale segments thus correspond to a contribution margin before network costs.

Segment expense encompasses the direct and indirect costs, which include personnel expense, other operating costs less capitalised costs of self-constructed assets and other income. Pension cost includes ordinary employer contributions. The difference between the ordinary employer contributions and the pension cost as provided for under IAS 19 is reported in the column ‘Eliminations’. In the first nine months of 2021, a gain of CHF 25 million is disclosed under ‘Eliminations’ as a pension cost reconciliation item in accordance with IAS 19 (prior year: expense of CHF 47 million).

Leases between the segments are not recognised in the balance sheet in accordance with IFRS 16. The reported lease expense of the segments comprises depreciation and interest on leases excluding depreciation of indefeasible rights of use (IRU) of CHF 18 million (prior year: CHF 18 million) and the accounting for the rental of buildings between segments. In addition, the leasing expenses of the previous year’s segments do not include allowances on right-of-use assets amounting to CHF 7 million. The lease expense of assets of low value is presented as direct costs.

Capital expenditure consists of the purchase of property, plant and equipment and intangible assets and payments for indefeasible rights of use (IRU). In general, IRUs are paid in full at the beginning of the use and are classified as leases under IFRS 16. From an economic point of view, IRU payments will be considered as capital expenditure in the segment information. Capital expenditure in the first nine months of 2021 includes IRU payments of CHF 11 million (prior year: CHF 11 million).

Swisscom Switzerland sells some mobile handsets on a subsidised basis in a bundled offering with a mobile communications contract. As a result of the reallocation of revenue over the pre-delivered components (mobile handset), revenue is recognised earlier than the date of invoicing. This results in contract assets deriving from this business being recognised. In the segment reporting of Swisscom Switzerland, the recognition and dissolution of these contract assets is reported as other revenue. The amounts invoiced are reported under revenue from telecommunications services or merchandise.

Segment information 2021

1.01.–30.09.2021, in CHF million |

Swisscom Switzerland |

Fastweb |

Other Operating Segments |

Elimination |

Total |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Residential customers | 3,366 | 934 | – | – | 4,300 | |||||

| Corporate customers | 2,246 | 776 | 326 | – | 3,348 | |||||

| Wholesale customers | 498 | 197 | – | – | 695 | |||||

| Net revenue from external customers | 6,110 | 1,907 | 326 | – | 8,343 | |||||

| Net revenue from other segments | 40 | 7 | 444 | (491) | – | |||||

| Net revenue | 6,150 | 1,914 | 770 | (491) | 8,343 | |||||

| Direct costs | (1,321) | (702) | (56) | 48 | (2,031) | |||||

| Indirect costs | (2,153) | (556) | (578) | 440 | (2,847) | |||||

| Segment result before depreciation and amortisation | 2,676 | 656 | 136 | (3) | 3,465 | |||||

| Lease expense | (174) | (43) | (9) | – | (226) | |||||

| Depreciation, amortisation and impairment losses | (1,120) | (480) | (40) | 8 | (1,632) | |||||

| Segment result | 1,382 | 133 | 87 | 5 | 1,607 | |||||

| Interest expense on lease liabilities | 33 | |||||||||

| Operating income | 1,640 | |||||||||

| Financial income and financial expense, net | 138 | |||||||||

| Result of equity-accounted investees | (5) | |||||||||

| Income before income taxes | 1,773 | |||||||||

| Income tax expense | (237) | |||||||||

| Net income | 1,536 | |||||||||

| Segment result before depreciation and amortisation | 2,676 | 656 | 136 | (3) | 3,465 | |||||

| Lease expense | (174) | (43) | (9) | – | (226) | |||||

| Capital expenditure | (1,125) | (479) | (29) | 28 | (1,605) | |||||

| Operating free cash flow proxy | 1,377 | 134 | 98 | 25 | 1,634 |

Segment information Swisscom Switzerland 2021

1.01.–30.09.2021, in CHF million |

Residential Customers |

Business Customers |

Wholesale |

Infrastructure & Support Functions |

Elimination |

Total Swisscom Switzerland |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fixed-line | 1,491 | 652 | – | – | – | 2,143 | ||||||

| Mobile | 1,396 | 537 | – | – | – | 1,933 | ||||||

| Revenue other | – | 46 | – | – | – | 46 | ||||||

| Telecom services | 2,887 | 1,235 | – | – | – | 4,122 | ||||||

| Solutions business | – | 821 | – | – | – | 821 | ||||||

| Merchandise | 399 | 168 | – | – | – | 567 | ||||||

| Wholesale | – | – | 498 | – | – | 498 | ||||||

| Revenue other | 80 | 6 | – | 16 | – | 102 | ||||||

| Net revenue from external customers | 3,366 | 2,230 | 498 | 16 | – | 6,110 | ||||||

| Net revenue from other segments | 57 | 55 | 241 | 41 | (354) | 40 | ||||||

| Net revenue | 3,423 | 2,285 | 739 | 57 | (354) | 6,150 | ||||||

| Direct costs | (821) | (599) | (326) | (5) | 430 | (1,321) | ||||||

| Indirect costs | (494) | (698) | (15) | (869) | (77) | (2,153) | ||||||

| Segment result before depreciation and amortisation | 2,108 | 988 | 398 | (817) | (1) | 2,676 | ||||||

| Lease expense | (30) | (24) | – | (120) | – | (174) | ||||||

| Depreciation, amortisation and impairment losses | (39) | (50) | – | (1,032) | 1 | (1,120) | ||||||

| Segment result | 2,039 | 914 | 398 | (1,969) | – | 1,382 | ||||||

| Capital expenditure | (16) | (30) | – | (1,079) | – | (1,125) |

Segment information 2020

1.01.–30.09.2020, in CHF million, restated |

Swisscom Switzerland |

Fastweb |

Other Operating Segments |

Elimination |

Total |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Residential customers | 3,320 | 903 | – | – | 4,223 | |||||

| Corporate customers | 2,276 | 707 | 329 | – | 3,312 | |||||

| Wholesale customers | 490 | 176 | – | – | 666 | |||||

| Net revenue from external customers | 6,086 | 1,786 | 329 | – | 8,201 | |||||

| Net revenue from other segments | 44 | 6 | 426 | (476) | – | |||||

| Net revenue | 6,130 | 1,792 | 755 | (476) | 8,201 | |||||

| Direct costs | (1,251) | (648) | (51) | 44 | (1,906) | |||||

| Indirect costs | (2,200) | (536) | (566) | 363 | (2,939) | |||||

| Segment result before depreciation and amortisation | 2,679 | 608 | 138 | (69) | 3,356 | |||||

| Lease expense | (175) | (42) | (9) | – | (226) | |||||

| Depreciation, amortisation and impairment losses | (1,139) | (462) | (46) | 6 | (1,641) | |||||

| Segment result | 1,365 | 104 | 83 | (63) | 1,489 | |||||

| Interest expense on lease liabilities | 34 | |||||||||

| Operating income | 1,523 | |||||||||

| Financial income and financial expense, net | (113) | |||||||||

| Result of equity-accounted investees | 4 | |||||||||

| Income before income taxes | 1,414 | |||||||||

| Income tax expense | (248) | |||||||||

| Net income | 1,166 | |||||||||

| Segment result before depreciation and amortisation | 2,679 | 608 | 138 | (69) | 3,356 | |||||

| Lease expense | (175) | (42) | (9) | – | (226) | |||||

| Capital expenditure | (1,186) | (439) | (30) | 23 | (1,632) | |||||

| Operating free cash flow proxy | 1,318 | 127 | 99 | (46) | 1,498 |

Segment information Swisscom Switzerland 2020

1.01.–30.09.2020, in CHF million, restated |

Residential Customers |

Business Customers |

Wholesale |

Infrastructure & Support Functions |

Elimination |

Total Swisscom Switzerland |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fixed-line | 1,505 | 676 | – | – | – | 2,181 | ||||||

| Mobile | 1,460 | 575 | – | – | – | 2,035 | ||||||

| Revenue other | – | 45 | – | – | – | 45 | ||||||

| Telecom services | 2,965 | 1,296 | – | – | – | 4,261 | ||||||

| Solutions business | – | 786 | – | – | – | 786 | ||||||

| Merchandise | 355 | 171 | – | – | – | 526 | ||||||

| Wholesale | – | – | 490 | – | – | 490 | ||||||

| Revenue other | – | 6 | – | 17 | – | 23 | ||||||

| Net revenue from external customers | 3,320 | 2,259 | 490 | 17 | – | 6,086 | ||||||

| Net revenue from other segments | 56 | 56 | 237 | 46 | (351) | 44 | ||||||

| Net revenue | 3,376 | 2,315 | 727 | 63 | (351) | 6,130 | ||||||

| Direct costs | (750) | (594) | (324) | (7) | 424 | (1,251) | ||||||

| Indirect costs | (557) | (705) | (12) | (853) | (73) | (2,200) | ||||||

| Segment result before depreciation and amortisation | 2,069 | 1,016 | 391 | (797) | – | 2,679 | ||||||

| Lease expense | (33) | (25) | – | (117) | – | (175) | ||||||

| Depreciation, amortisation and impairment losses | (54) | (57) | – | (1,028) | – | (1,139) | ||||||

| Segment result | 1,982 | 934 | 391 | (1,942) | – | 1,365 | ||||||

| Capital expenditure | (19) | (27) | – | (1,140) | – | (1,186) |