Cash flows

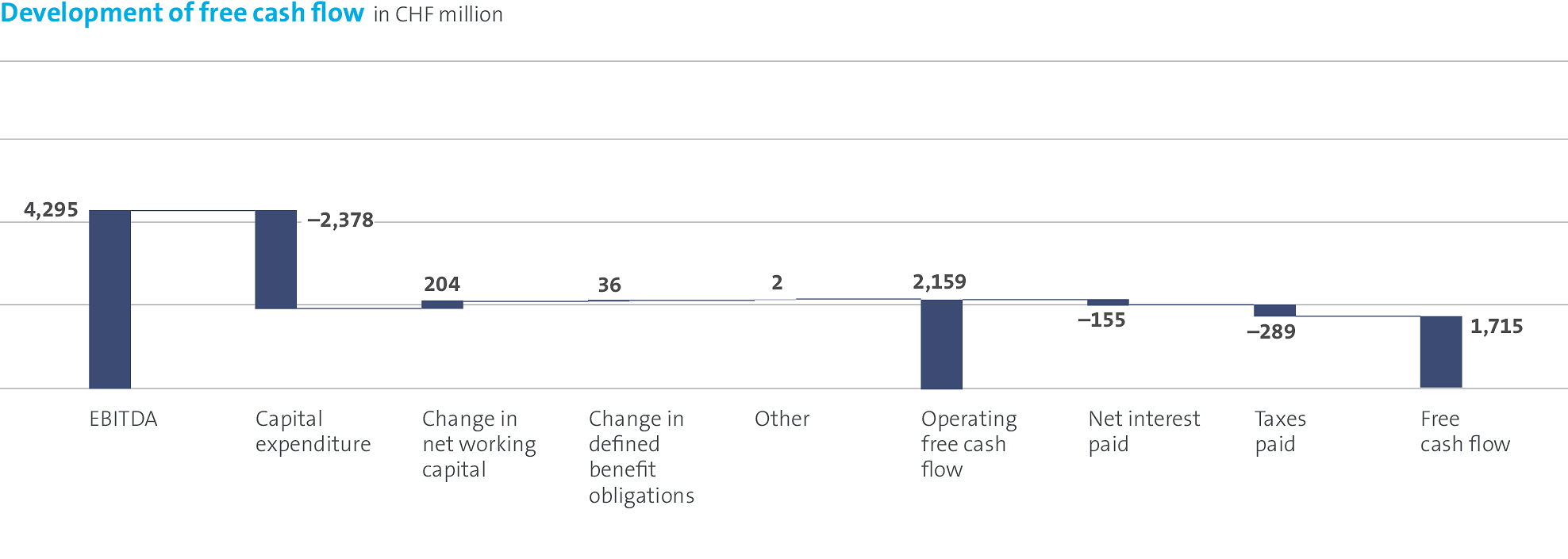

| In CHF million | 2017 | 2016 | Change | |||

|---|---|---|---|---|---|---|

| Operating income before depreciation and amortisation (EBITDA) | 4,295 | 4,293 | 2 | |||

| Capital expenditure in property, plant and equipment and intangible assets | (2,378) | (2,416) | 38 | |||

| Change in net working capital and other cash flows from operating activities | 242 | (86) | 328 | |||

| Operating free cash flow | 2,159 | 1,791 | 368 | |||

| Net interest paid | (155) | (157) | 2 | |||

| Income taxes paid | (289) | (328) | 39 | |||

| Free cash flow | 1,715 | 1,306 | 409 | |||

| Net expenditures for company acquisitions and disposals | (106) | 43 | (149) | |||

| Other cash flows from investing activities, net | 120 | (87) | 207 | |||

| Issuance and repayment of financial liabilities, net | (401) | (101) | (300) | |||

| Dividends paid to equity holders of Swisscom Ltd | (1,140) | (1,140) | – | |||

| Other cash flows | (9) | (14) | 5 | |||

| Net increase in cash and cash equivalents | 179 | 7 | 172 |

Free cash flow increased year-on-year by CHF 409 million to CHF 1,715 million, mainly due to higher operating free cash flow. Operating free cash flow increased by CHF 368 million to CHF 2,159 million. In the previous year, cash flow was affected by the payment of the penalty of CHF 186 million for the ongoing Competition Commission proceedings regarding broadband services. Swisscom does not consider the sanction justified and has lodged an appeal with the Federal Court. It paid the penalty of CHF 186 million in the first quarter of 2016, as no suspensive effect had been granted. Excluding this payment, operating free cash flow rose by CHF 182 million or 9.2% versus the previous year. This is attributable primarily to lower trade receivables, on the one hand, and prepaid expenses, on the other. In the second quarter of 2017, the Swisscom pension fund (comPlan) also received a one-time payment of CHF 50 million as a result of the pension fund changes communicated in October 2016.

Net expenditure for company acquisitions and disposals amounted to CHF 106 million (prior year: net proceeds of CHF 43 million). This includes, in particular, the purchase of a Tiscali business division by Fastweb and the acquisition of the remaining shares of Cinetrade (prior year: sale of stake in Metroweb). Other cash flows chiefly include the taking out and repayment of fixed-term deposits. In 2017, Swisscom issued debenture bonds with an aggregate nominal value of CHF 500 million and paid back debenture bonds and private placements totalling around CHF 900 million.