Value-oriented business management

Key performance indicators for planning and managing business operations are revenue, operating income before depreciation and amortisation (EBITDA) and capital expenditure. The enterprise value/EBITDA ratio permits comparison with the value of comparable companies (European telecommunications companies) and with its own figure for the prior year. The members of the Board of Directors and Group Executive Board are paid a portion of their remuneration in the form of Swisscom shares, which are blocked for a period of three years. They are also subject to a minimum shareholding requirement. Variable remuneration based on financial and non-financial targets, the partial settlement of remuneration in shares and the minimum shareholding requirement ensure that the financial interests of management are aligned with the interests of shareholders.

| In CHF million, except where indicated | 31.12.2022 | 31.12.2021 | |||

|---|---|---|---|---|---|

| Enterprise value | |||||

| Market capitalisation | 26,243 | 26,657 | |||

| Net debt | 7,374 | 7,706 | |||

| Defined benefit assets and obligations, net | 11 | 13 | |||

| Income tax assets and liabilities, net | 829 | 835 | |||

| Equity-accounted investees and other non-current financial assets | (419) | (459) | |||

| Non-controlling interests | 3 | 2 | |||

| Enterprise value (EV) | 34,041 | 34,754 | |||

| Operating income before depreciation and amortisation (EBITDA) | 4,406 | 4,478 | |||

| Ratio enterprise value/EBITDA | 7.7 | 7.8 | |||

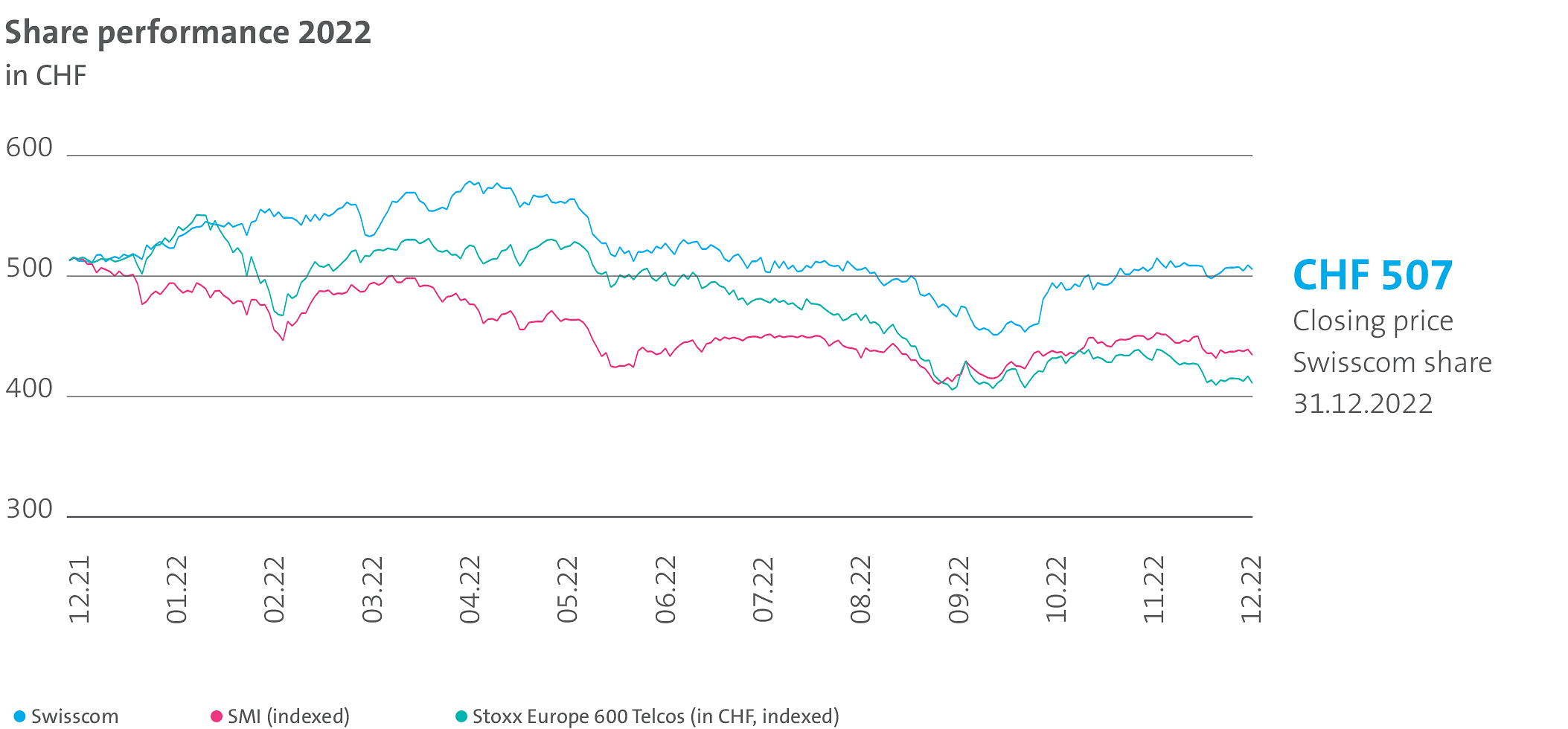

Swisscom’s enterprise value fell by CHF 0.7 billion (–2.0%) to CHF 34 billion in 2022. The main reasons were, on the one hand, a decrease in market capitalisation (CHF –0.4 billion) and, on the other hand, a decrease in net debt (CHF –0,3 billion). The enterprise value/EBITDA ratio of 7.7x is slightly lower than the prior-year figure. Measured against this ratio, Swisscom’s relative valuation is well above the average for comparable companies in Europe’s telecoms sector. The higher relative valuation is supported by Swisscom’s solid market position and attractive dividend. In addition, the lower interest rates and lower corporate income tax rates in Switzerland compared with other European countries have a positive effect on its enterprise value.