Cash flows

| In CHF million | 2019 | 2018 | Change | |||

|---|---|---|---|---|---|---|

| Operating income before depreciation and amortisation (EBITDA) | 4,358 | 4,213 | 145 | |||

| Capital expenditure | (2,438) | (2,404) | (34) | |||

| Lease expense | (294) | – | (294) | |||

| Operating free cash flow proxy | 1,626 | 1,809 | (183) | |||

| Change in net working capital | 146 | (139) | 285 | |||

| Change in defined benefit obligations | 48 | 64 | (16) | |||

| Net interest payments for financial assets and liabilities | (63) | (109) | 46 | |||

| Interest payments on finance lease liabilities | – | (24) | 24 | |||

| Income taxes paid | (371) | (294) | (77) | |||

| Other operating cash flow | (41) | 12 | (53) | |||

| Free cash flow | 1,345 | 1,319 | 26 | |||

| Net expenditures for company acquisitions and disposals | (413) | (113) | (300) | |||

| Other cash flows from investing activities, net | 39 | 19 | 20 | |||

| Issuance of financial liabilities | 417 | 1,451 | (1,034) | |||

| Repayment of financial liabilities | (374) | (1,545) | 1,171 | |||

| Repayment of financial lease liabilities according to IAS 17 | – | (26) | 26 | |||

| Dividends paid to equity holders of Swisscom Ltd | (1,140) | (1,140) | – | |||

| Other cash flows from financing activities | (16) | (10) | (6) | |||

| Net decrease in cash and cash equivalents | (142) | (45) | (97) |

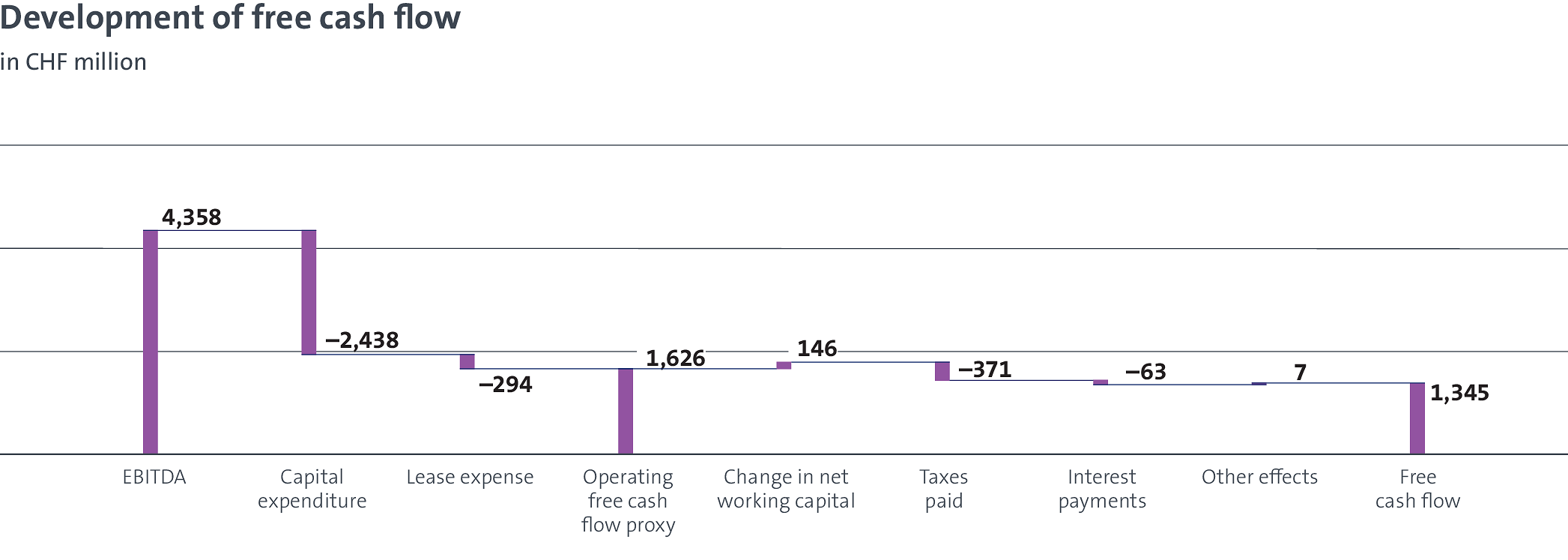

The operating free cash flow proxy declined year-on-year by CHF 183 million to CHF 1,626 million, owing largely to higher capital expenditure. Capital expenditure rose by CHF 34 million to CHF 2,438 million. This was driven by the expenditure of CHF 196 million for the mobile radio frequencies purchased by Swisscom Switzerland at auction in the first half of 2019. Excluding Swisscom’s purchase of mobile radio frequencies, the operating free cash flow proxy rose by CHF 13 million.

Free cash flow increased year-on-year by CHF 26 million to CHF 1,345 million, fuelled largely by the improvement in net working capital. Net working capital decreased by CHF 146 million compared to the end of 2018 (prior year: increase of CHF 139 million).

Net expenditure for company acquisitions and disposals amounted to CHF 413 million (prior year: CHF 113 million). This includes the payment for the purchase price of CHF 240 million paid to Tamedia for the acquisition of the outstanding share of 31% in Swisscom Directories Ltd. Also included are payments for the acquisition of Tiscali’s Fixed Wireless division by Fastweb as well as investments in equity-accounted investee Flash Fiber in connection with the network expansion in Italy. Swisscom issued various bonds totalling CHF 405 million in 2019. The funds received were used to repay existing loans.