Cash flows

| In CHF million | 2021 | 2020 | Change | |||

|---|---|---|---|---|---|---|

| Operating income before depreciation and amortisation (EBITDA) | 4,478 | 4,382 | 96 | |||

| Lease expense | (301) | (300) | (1) | |||

| EBITDA after lease expense (EBITDA AL) | 4,177 | 4,082 | 95 | |||

| Capital expenditure | (2,286) | (2,229) | (57) | |||

| Operating free cash flow proxy | 1,891 | 1,853 | 38 | |||

| Change in net working capital | (19) | 140 | (159) | |||

| Change in defined benefit obligations | (9) | 65 | (74) | |||

| Net interest payments on financial assets and liabilities | (67) | (69) | 2 | |||

| Income taxes paid | (279) | (309) | 30 | |||

| Other operating cash flow | (4) | 26 | (30) | |||

| Free cash flow | 1,513 | 1,706 | (193) | |||

| Dividends paid to equity holders of Swisscom Ltd | (1,140) | (1,140) | – | |||

| Net expenditures for company acquisitions and disposals | 105 | (54) | 159 | |||

| Other changes | 51 | 28 | 23 | |||

| Decrease in net debt | 529 | 540 | (11) |

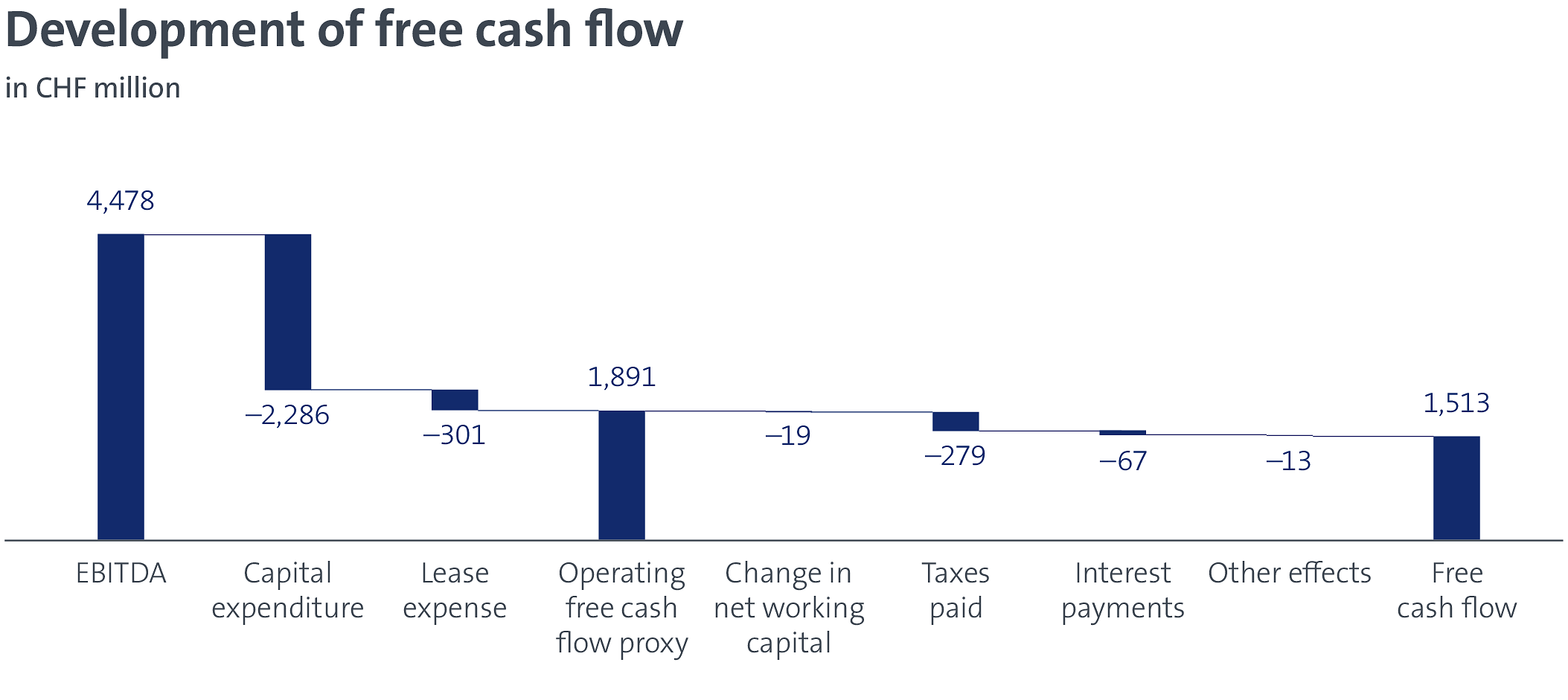

The operating free cash flow proxy increased by 2.1% or CHF 38 million year-on-year to CHF 1,891 million. The higher operating income before depreciation and amortisation (EBITDA) was partially offset by the increased capital expenditure. Free cash flow decreased by 11.3% or CHF 193 million to CHF 1,513 million. Overall, net debt decreased by 8.5% or CHF 529 million to CHF 5,689 million.

The decrease in free cash flow was mainly attributable to the change in net working capital. Net working capital went up by CHF 19 million in 2021 (prior year: decrease of CHF 140 million). The change in defined benefit obligations includes a one-off adjustment of CHF 60 million arising from a plan amendment in the first half of 2021, which is recognised in EBITDA. In 2021, net cash inflows from acquisitions and disposals included the proceeds of CHF 126 million from the sale of the participation in Belgacom International Carrier Services. Swisscom paid an unchanged dividend of CHF 22 per share in 2021. This is equivalent to a total dividend payout of CHF 1,140 million.